Understanding SSI Apartment Rentals: A Practical Overview

SSI can be an important income source for people with disabilities or older adults, but it does not automatically come with housing. Renting with SSI typically involves using income-restricted properties or subsidy programs administered by housing agencies. This overview explains how these rentals usually work, what paperwork is commonly required, and how rent is often calculated.

Understanding SSI Apartment Rentals: A Practical Overview

SSI apartment rentals are often misunderstood because there is no single category of housing that is officially labeled an SSI apartment. In practice, the term usually refers to rentals that accept tenants whose income includes Supplemental Security Income (SSI) and that may be paired with income-restricted units, housing vouchers, or other subsidies. Because SSI is a United States program, readers in other countries can use the same concepts to understand similar disability or income-based housing supports where they live.

Want to understand SSI-eligible apartments?

Want to understand how SSI-eligible apartments function? Get clear insights into the requirements, options, and steps involved. Continue reading. Most of the time, SSI-eligible simply means the apartment is financially workable with SSI and the landlord accepts lawful income sources, including benefits. The more technical piece is whether the unit is part of a program, such as a voucher-friendly rental, public housing, or a tax-credit property with income limits. These options vary by location, and many have waiting lists, so the practical approach is to learn which program type you are applying to and what rules come with it.

Not sure how SSI-compatible housing works?

Not sure how SSI-compatible housing works? Discover the basics, what applicants should know, and how these apartments are structured. Read more. Landlords and housing agencies generally evaluate eligibility using income, household size, identity documentation, and sometimes disability-related eligibility if a program is specifically designated for people with disabilities. It also helps to separate these concepts: SSI is the income stream; the housing program is what determines how rent is set and what protections or responsibilities apply. In many cases, a tenant uses SSI to pay their portion while the program pays the remaining subsidy directly to the property owner.

Tips for Finding the Right Apartment

Finding a suitable rental on SSI often comes down to widening the search channels and preparing documentation early. Start with local services such as public housing authority listings, nonprofit housing counselors, and government portals that list income-restricted properties. When contacting property managers, ask whether the unit accepts vouchers, whether it is income-restricted, and what screening criteria apply (credit checks, rental history, or criminal background rules may differ by program and jurisdiction). If you need accessibility features or a live-in aide, learn how reasonable accommodations are requested in your area and keep communications and paperwork organized so you can respond quickly when a unit becomes available.

Income-Based Rent Calculations in Subsidized Housing

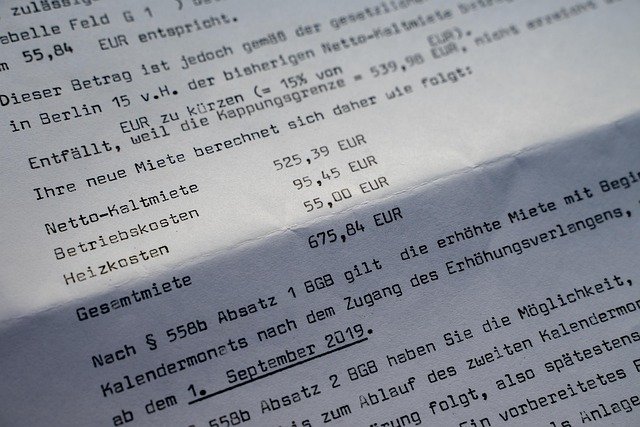

Understanding Income-Based Rent Calculations: How Subsidized Housing Programs Determine Monthly Payment Amounts is essential because it explains why two households with the same rent may pay different amounts. Many subsidy models use a percentage of adjusted income, not just gross income, and adjustments can include certain deductions (which vary by program). Utilities can also change the effective monthly cost: some programs apply a utility allowance, meaning the tenant may pay part of utilities directly while the rent portion is reduced. It is also common to see minimum rent rules, interim recertifications after income changes, and annual reviews that can raise or lower the tenant portion over time.

Real-world cost and pricing insights depend on the program structure, but a common benchmark in U.S. subsidized housing is that the tenant pays around 30 percent of adjusted monthly income toward rent and utilities, with the remainder covered by the subsidy when applicable. For someone relying primarily on SSI, this can make the tenant portion more predictable than market-rate rent, but up-front costs (security deposit, moving costs, utility deposits) may still apply. The table below compares widely used U.S. housing pathways that SSI recipients often use, noting typical tenant payment methods and what the cost is based on.

| Product/Service | Provider | Cost Estimation |

|---|---|---|

| Housing Choice Voucher (Section 8) | HUD administered through local Public Housing Agencies | Tenant portion often about 30% of adjusted income; remainder subsidized, with possible utility allowance |

| Public Housing | Local Public Housing Agencies (supported by HUD) | Tenant rent commonly based on income (often around 30% of adjusted income), subject to program rules |

| Project-Based Rental Assistance | HUD with property owners under contract | Tenant portion typically income-based (often around 30% of adjusted income) while assistance stays with the unit |

| Low-Income Housing Tax Credit (LIHTC) units | State housing finance agencies allocate credits; properties run by private owners | Rent is usually capped by program formulas tied to area median income limits, not always individualized to the tenant |

| USDA Rural Development rentals (Section 515/521) | USDA Rural Development and participating properties | Tenant payment can be income-based when rental assistance applies; otherwise may be below-market but not fully income-based |

Prices, rates, or cost estimates mentioned in this article are based on the latest available information but may change over time. Independent research is advised before making financial decisions.

A practical takeaway is to confirm which rent-setting method applies before you apply: voucher and many assisted programs tend to adjust your share based on your income, while some income-restricted properties use capped rents that may still be difficult on SSI in high-cost areas. Because rules and paperwork requirements vary, it is also important to ask how recertification works, what happens if your income changes, and whether the program includes utility allowances or separate tenant-paid utilities. With clearer expectations about program type, documentation, and rent calculations, SSI recipients can more realistically compare units and avoid surprises after approval.